A Superficial Calm in Bond Markets

The bond markets in 2023 have presented an unnerving calm that belies deeper vulnerabilities. At first glance, the minor fluctuations in yields for municipal bonds (munis) and U.S. Treasuries suggest stability, yet this perception is deceptive. Often, a quiet market masks an accumulation of pressures poised to trigger abrupt corrections. Marginal yield increases—particularly in long-term munis hovering around or just above 2%—reflect temporary equilibrium rather than true market strength. This subtle pause has lulled investors into a false sense of security, encouraging overconfidence in valuations disconnected from fundamental economic realities.

Recent trends indicate that while the broader market appears to be consolidating, the underlying momentum in financial assets has been stretched. Investor complacency, particularly among retail participants, has driven inflows into mutual funds and ETFs, often at valuations that fail to reflect real risk. Such herd behavior exacerbates the gap between perceived and actual value, heightening the probability of sudden market corrections once economic fundamentals reassert themselves.

Valuations and Yield Curves: The Illusion of Safety

Analyzing current valuation metrics exposes a fragile landscape. AAA-rated long-term municipal bonds are trading at yields that appear artificially low, creating the impression of low risk while potentially concealing overvaluation. The widening gap between municipal yields and corresponding Treasury yields—the muni-UST ratio—raises questions about whether these instruments truly offer relative value or are simply buoyed by excess liquidity. Steep municipal yield curves, exceeding double the slope of equivalent Treasury curves, signal optimism, yet this optimism may be fragile and susceptible to reversals.

Compounding concerns, the inversion of yield curves for the 2026–2030 maturities suggests underlying market apprehension about future economic growth. While inversions historically precede slowdowns or recessions, many investors have seemed indifferent, lured by short-term gains. This disconnect underscores a critical tension: the apparent security of current yields may be undermining prudent risk assessment.

The remarkable outperformance of long-term bonds—some indices reporting gains above 4.5%—highlights both reward and risk. While these returns entice patience, they also amplify late-cycle vulnerability. Even high-yield municipal segments, with modest year-to-date gains of roughly 1.68%, may provide limited cushioning in the event of a sudden sentiment shift.

Supply and Demand Dynamics: Capital Flows Out of Sync

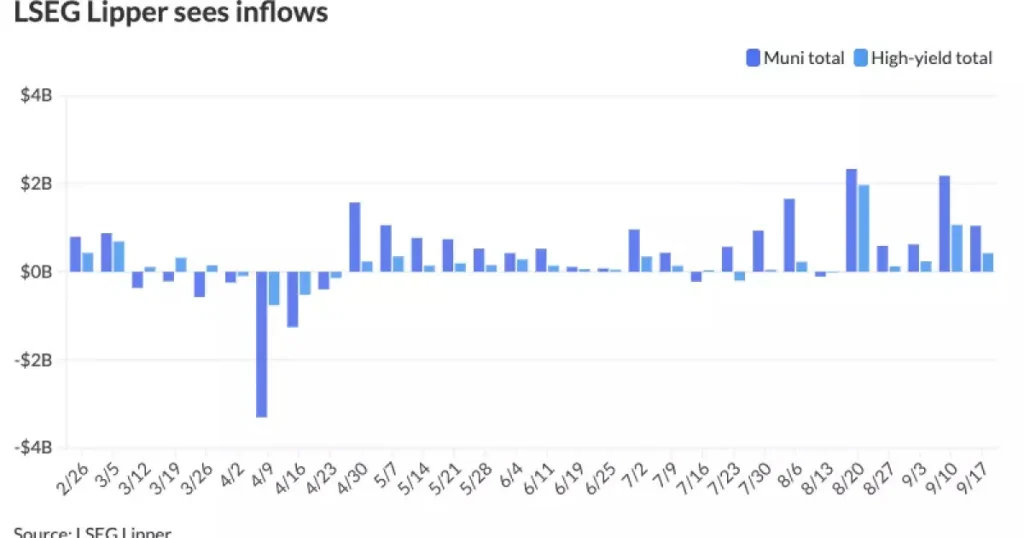

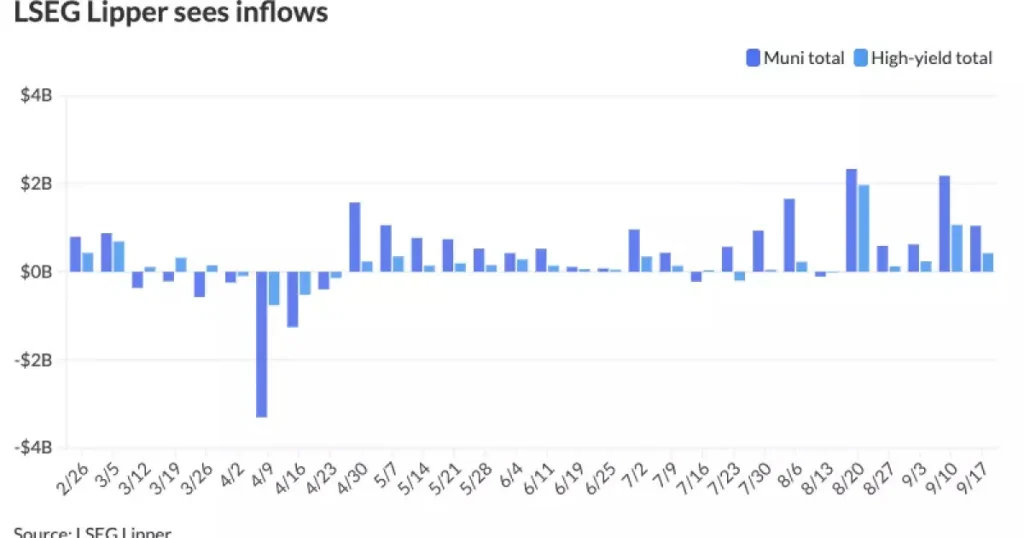

Despite warnings of overheating, municipal bonds continue to attract inflows, though at a more moderated pace. Recent figures indicate over $1 billion added to municipal bond funds—a decline from prior weeks’ surges—suggesting potential changes in investor sentiment. Yet, overall enthusiasm persists, driven by perceived value and expectations of continued low yields.

The risk is that liquidity-driven demand may inflate valuations beyond fundamental justification. Withdrawals of over $1 billion from tax-exempt funds by money market participants point to ongoing sensitivity to liquidity or risk appetite. Stable readings in indexes like the SIFMA Swap Index may mask these underlying tensions, offering a false sense of security even as dealer inventories remain steady.

Municipal issuance continues to grow in states such as Texas, New York, and California, reflecting ongoing borrowing needs. However, surges in issuance combined with sluggish secondary market liquidity could distort pricing, making it difficult for investors to accurately gauge risk. The pursuit of extended maturities and higher yields, while rational from a return perspective, may clash with fiscal constraints and slower economic growth, creating hidden systemic risk.

The Role and Limits of Central Banking

Current low interest rates and staggered easing cycles have provided temporary support for bond valuations. Yet these conditions are inherently delicate. Markets may interpret rate adjustments as indicators of economic softness, yet this interpretation risks creating a false sense of perpetual support. As central banks approach the limits of policy tools, sudden hawkish shifts or unanticipated policy changes could quickly destabilize markets.

Investors locking capital into long-duration bonds at yields near 2% face the dual risk of rate tightening and resurgence of inflationary pressures. The narrow spreads observed in instruments like the SIFMA Swap Index reflect liquidity concentration rather than robust economic growth, and the absence of volatility may lull participants into underestimating potential disruptions.

Behavioral Risks and Market Psychology

Complacency in a seemingly stable market environment is often a precursor to sudden corrections. Retail investors chasing yield amplify this effect, with momentum-driven inflows creating pricing distortions. The disconnect between investor optimism and economic fundamentals, particularly amid inverted yield curves, presents a classic late-cycle risk scenario. Overextension without a fundamental basis increases the likelihood of abrupt market reversals, leaving even experienced investors vulnerable.

Psychologically, markets can sustain a veneer of calm while accumulating latent risk. Rewarding duration excessively, as seen with long-term municipal bonds, may encourage risk-taking beyond rational limits. Similarly, the allure of steady short-term gains can blind participants to macroeconomic signals, further heightening susceptibility to abrupt corrections.

Conclusion: Caution Amid Calm

The current bond market landscape is deceptively tranquil. While minor yield movements and continued inflows may suggest stability, these factors obscure deeper structural vulnerabilities. Artificially low yields, steep and inverted curves, and ongoing capital inflows driven by liquidity rather than fundamentals collectively suggest that the market may be perched on a fragile plateau.

Investors must temper optimism with caution. The apparent security of municipal and Treasury bonds, supported by low rates and steady demand, is vulnerable to sudden shifts in sentiment, policy changes, or macroeconomic shocks. Recognizing the underlying fragility and maintaining a disciplined assessment of risk is critical to navigating this environment successfully. In 2023, the calm of bond markets may be the most compelling warning signal of all.